Introducing Superbill

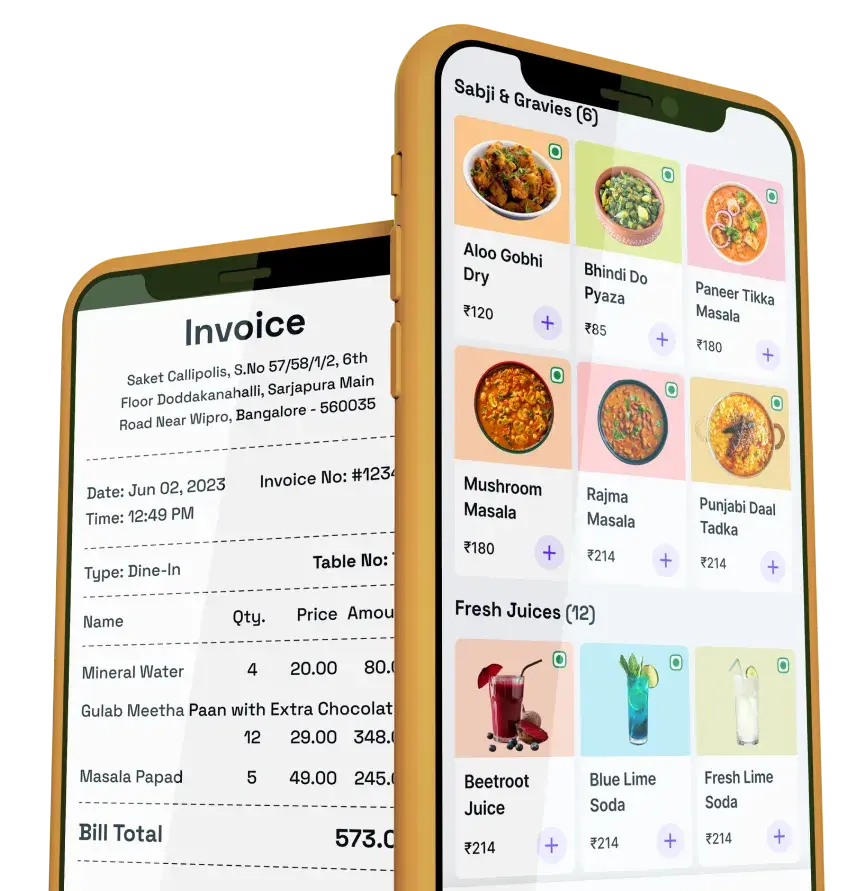

Mobile, Desktop & Tablet App

Mobile, Desktop & Tablet App

Introducing Superbill Bharat ka digital billing app

Bharat ka digital billing app

& Invoicing for

The only business management software you need - fully customizable for your business

Book Free Demo Now

Download the Mobile App fromPlay Store

Loved by businesses everywhere

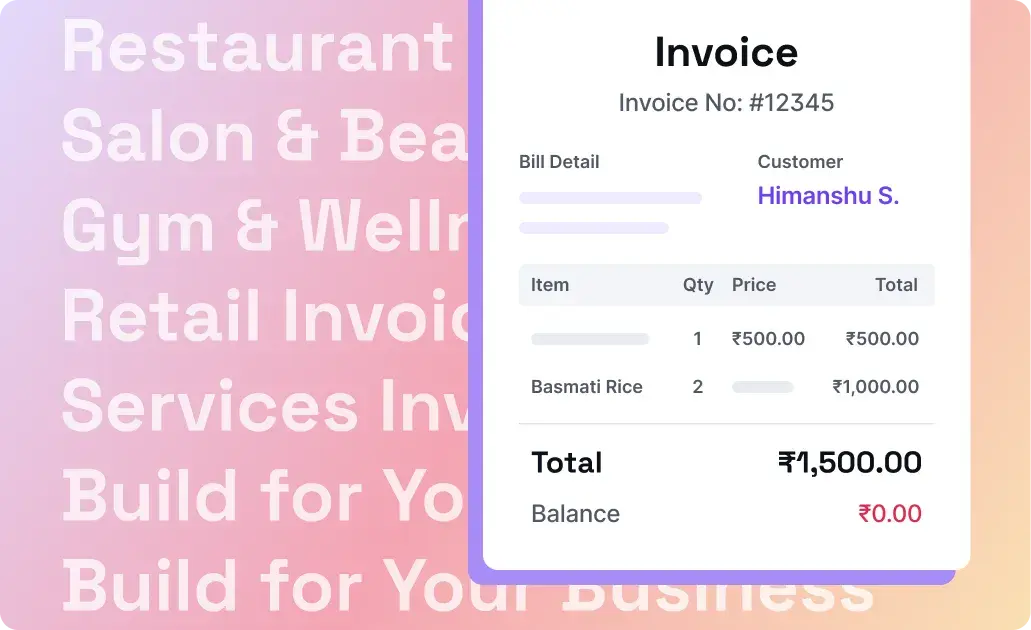

Personalized Bill for

Your Business

No more one-size-fits-all billing. Superbill creates customized bills and invoices tailored to your business type, whether you run a salon,...

read more

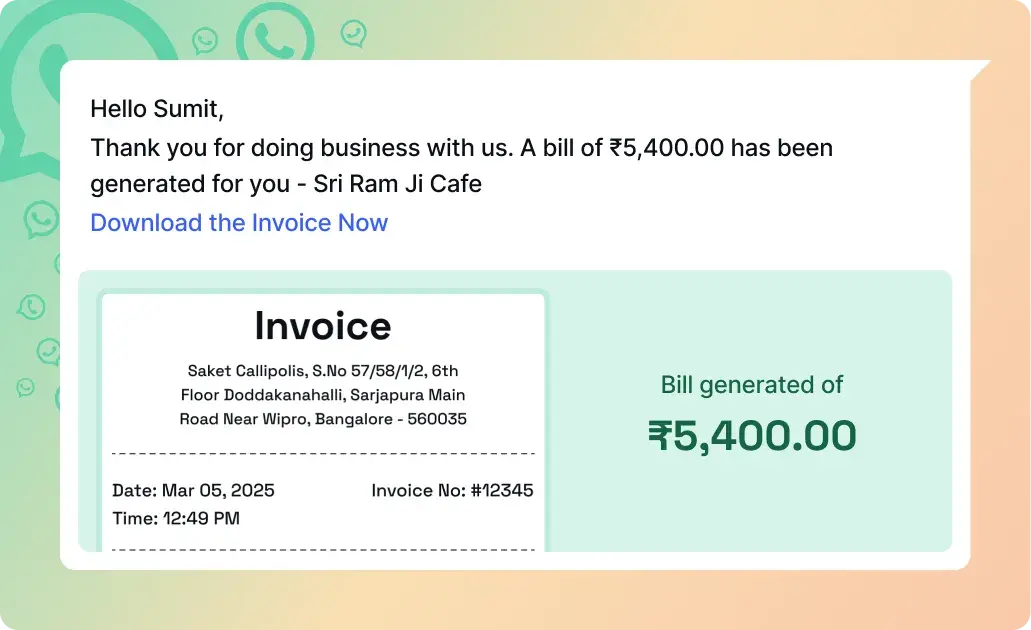

Send Invoices on

WhatsApp

Send bills, payment links, and receipts instantly to your customers via WhatsApp. Save time, get faster responses, and keep your...

read more

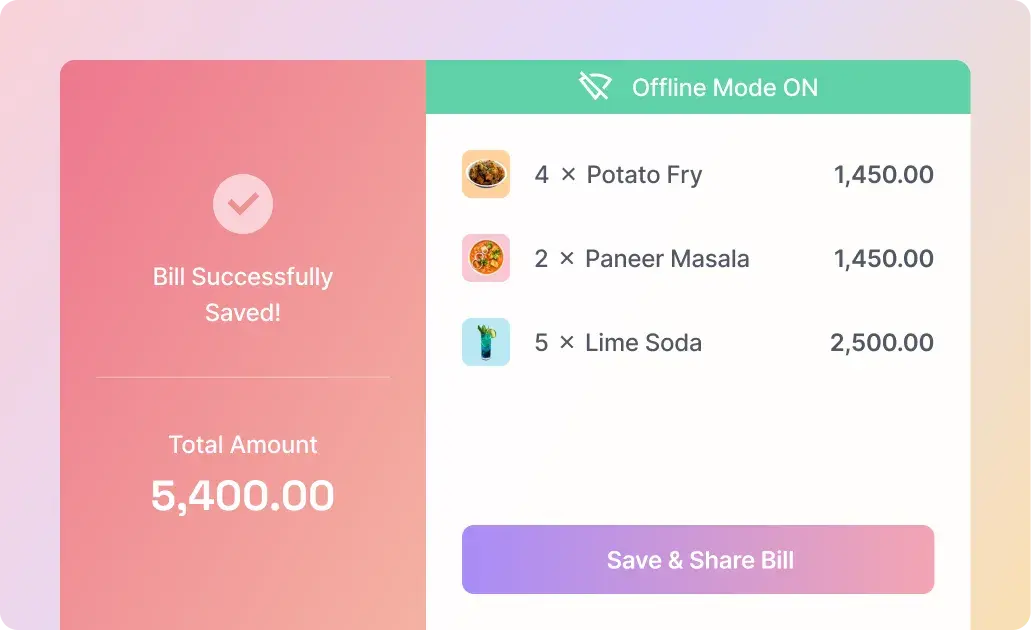

Works Online &

Offline

No internet? No problem. Superbill keeps your business running smoothly even when you're offline. Your data syncs automatically when you're...

read more

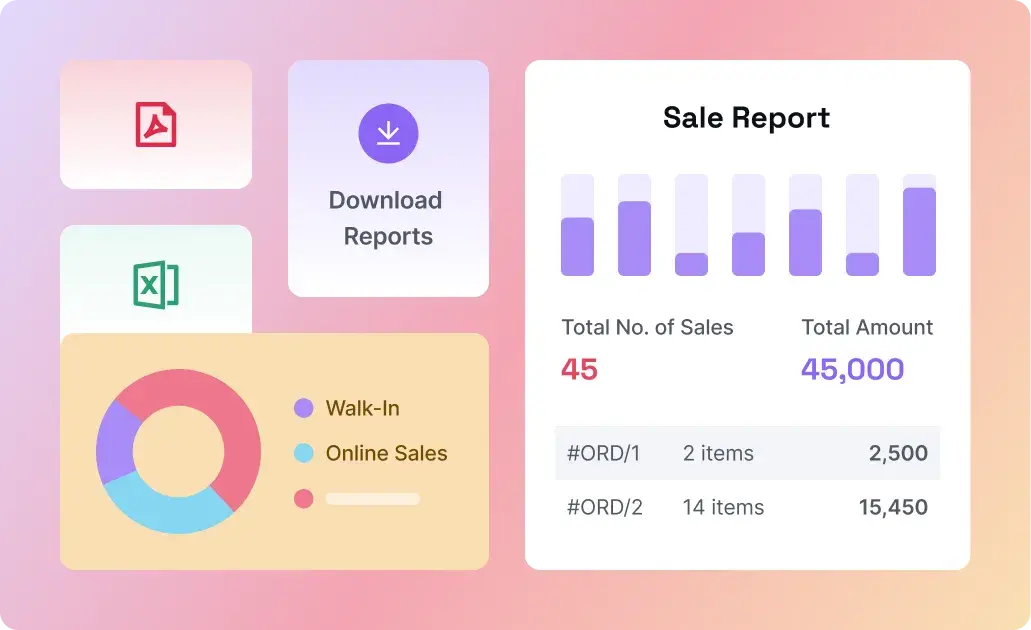

Instant GST Reports

& Insights

Track sales, payments, stock, and customer data in real-time. Superbill gives you powerful, easy-to-read reports so you always know what’s...

read more

Built for you.

Built for your business.

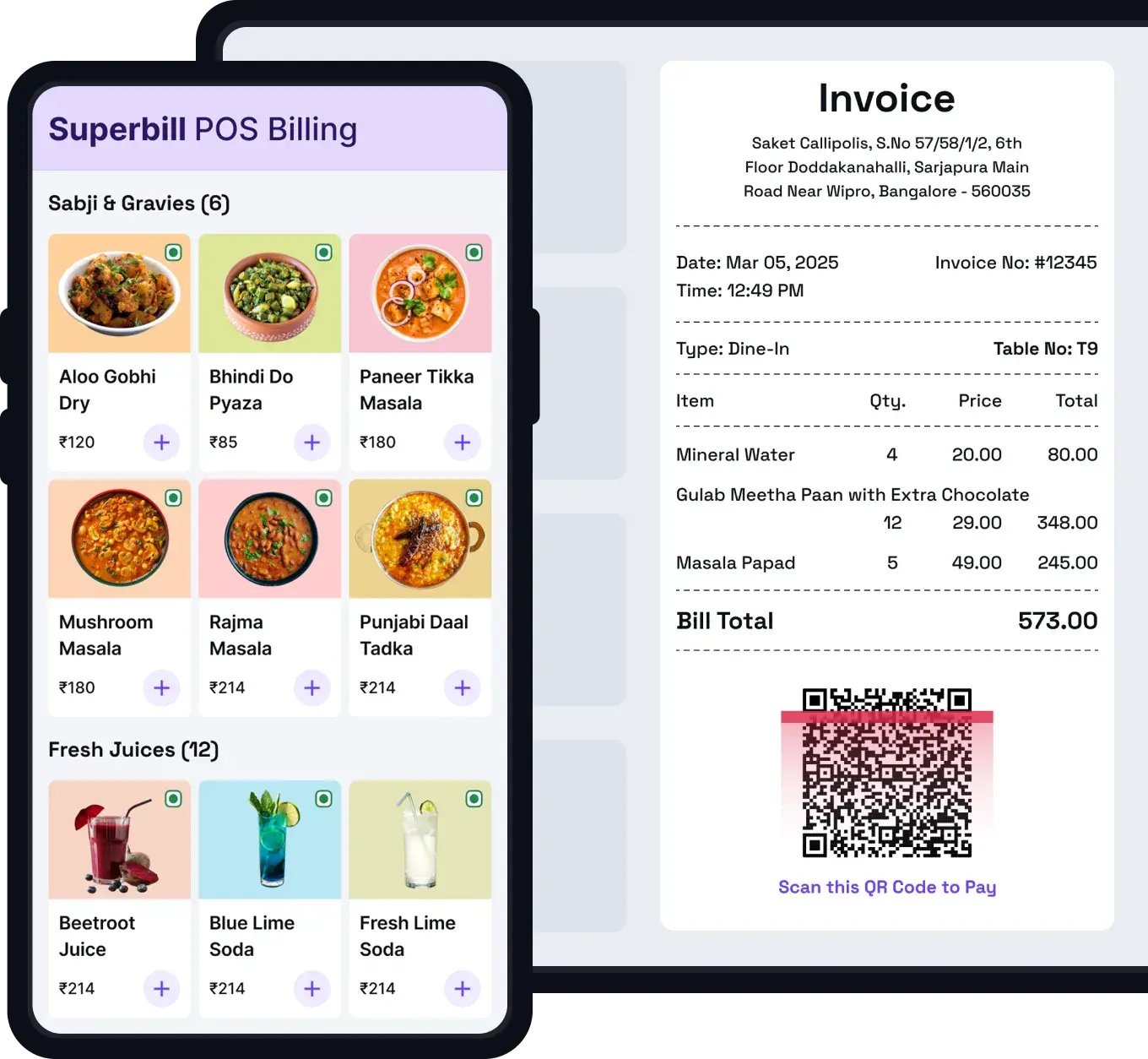

Restaurant, Food & Beverage

Manage orders, generate KOTs, and create GST-compliant bills in seconds. Superbill is designed for restaurants, cafes, food trucks, and cloud kitchens, with support for dine-in, takeaway, and delivery orders.

Track daily sales, split bills, manage tables, and print receipts, even without internet.

Restaurant billing software, POS for cafe and cloud kitchens, GST bill app for restaurants

Salon, Spa & Beauty

Gym, Health & Fitness

Retails

Services

Top Features of Our GST Billing Software

Features & Benefits of GST Billing and Accounting Software

POS & GST Billing

Smart POS, Invoicing and GST billing for India

Invoicing & Accounting

Easy invoicing and accounting for small businesses

Customer CRM

Manage customer data, history, and loyalty

Order Management

Track, manage, and fulfill customer orders easily

Expense Management

Record and monitor daily business expenses smartly

Purchase Bill

Create, store, and track vendor purchase bills

WhatsApp’s Bill

Send bills and receipts on WhatsApp instantly

Table, Floor & Seat

Restaurant table and floor-wise billing made easy

Payment reminders

Auto-send payment reminders to customers on time

Stock & Inventory

Real-time inventory and stock tracking system

GST Reports & Analytics

Download GST-ready reports and business insights

Online Store

Create your online store and sell anywhere

+20 more features

Frequently asked questions

Can’t find the answer here?

Check out our Help Center

What is the best billing software for small businesses?

What is the best billing software for small businesses?

What is billing software?

What is billing software?

What is an invoice?

What is an invoice?

How much does billing software cost?

How much does billing software cost?

Which software is best for GST billing?

Which software is best for GST billing?

Is there any free billing software available?

Is there any free billing software available?

Which is the best free billing software for PC?

Which is the best free billing software for PC?

What is offline billing software?

What is offline billing software?

What is the most affordable billing software?

What is the most affordable billing software?

How to generate and send invoices for free?

How to generate and send invoices for free?

Which is the best free billing software?

Which is the best free billing software?

I run a small restaurant and Superbill has really helped me. Billing is fast, I can manage tables easily, and daily reports are just one click. Even my staff finds it simple to use.

BBQ Bite, Ram Bhavani Singh, Punjab

1

2

3

4