What is the Difference Between Invoice and Bill?

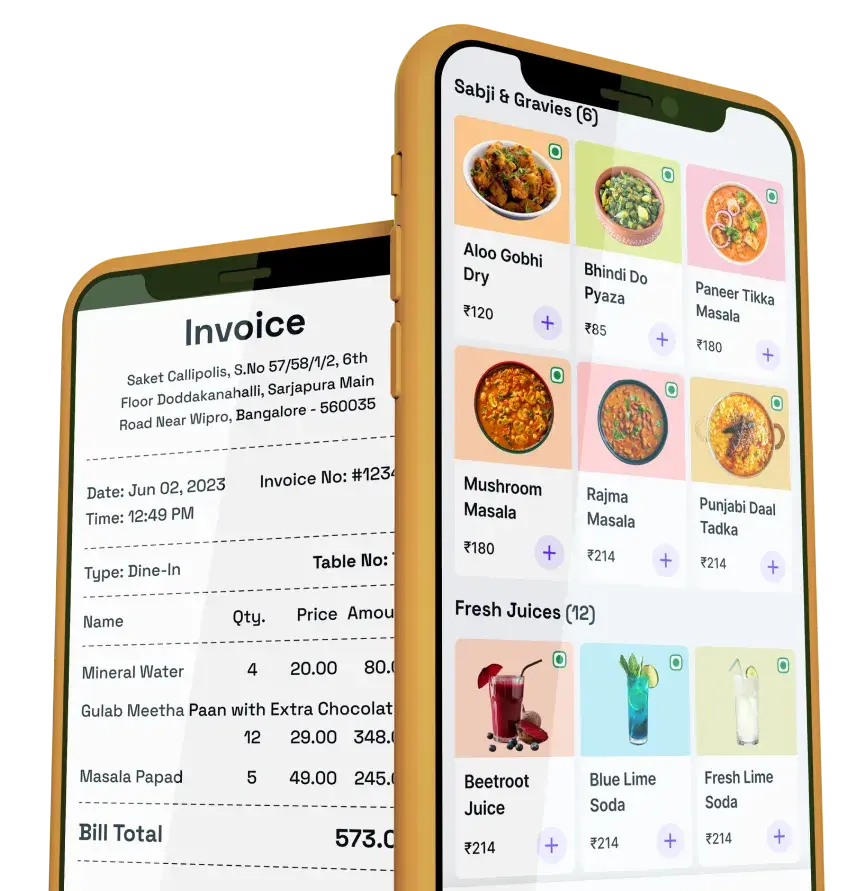

People interchangeably use the terms invoice and bill when they want to refer to the document that computes transactions between a seller and a buyer. However, they are different. A seller might have to create both an invoice and bill as proof of the transaction. Consider a restaurant management software or a billing system. When someone places an order at the restaurant, they create an order with items and print a KOT (Kitchen Order Ticket). After the order is served, the restaurant reviews the order and generates an invoice. Next, when the customer is ready to pay the bill, they print the bill and hand it over to the customer. So, the obvious question is how do they differ. How can we distinguish, looking at the two, which one is an invoice and which one is a bill? Let us understand this step-by-step for a clear understanding.

Invoice and Bill

A seller issues an invoice to the buyer in case of the sale of goods or services. It is a record that details goods and services the seller has to deliver and details quantity, price, payment options, and due dates.

As opposed to an invoice, the seller gives the buyer a bill after the delivery of goods or services and when the buyer has made payment.

Invoice VS Bill

Now, let us look at how they are different from each other against common criteria in a tabular comparison.

| Invoice vs. bill |

|---|

| # | Invoice | Bill |

|---|

| 1 | Generated and sent by a seller to a buyer as a record of purchase | Given by a seller to a buyer to request payment |

|---|

| 2 | Serves as a formal document of purchase | Records a transaction |

|---|

| 3 | Records item sold, quantity, and price | Computes items sold, quantity, prices, and the total bill |

|---|

| 4 | Includes applicable tax details and eligible discounts | Includes tax, discounts, and payment mode |

|---|

What is an Invoice?

An invoice is a legal document a seller gives to the buyer as a record of items being delivered. It has details of items, their quantity, price per unit, and the total amount after multiplying the price per unit by the quantity and adding them up. Other details include round-off details, packaging charges, taxes, and discounts.

What are the types of Invoices?

There are many types of invoices that businesses use based on their needs:

- Basic or Standard Invoice -It is the most basic invoice type with details that are necessary so that the buyer of the product or service can refer to it for transaction details.

- Interim Invoice -An invoice used to charge as the work progresses. So, instead of waiting for the entire project to finish, you can write an invoice for the work done at any given point during work.

- Recurring Invoice -It is an invoice from a seller to the buyer that occurs at regular intervals, monthly, quarterly, or yearly. Generally, invoicing of subscription-based purchases is recurring.

- Proforma Invoice -Sometimes, before sending the final invoice, an invoice with an estimated cost and sale terms is sent. It is called a proforma or a preliminary invoice.

- Credit Invoice -It is given to a customer in case of a refund. It is also called a credit note or a credit memo. Reasons for a refund can be item return, damaged product, pricing, or invoice errors.

- Debit Invoice -A customer gets a debit invoice when an amendment is to be made to the original invoice. It increases the amount the buyer owes to the seller.

- Timesheet Invoice -This invoice is given to a client with details of hours of work done, tasks completed, and the amount the client must pay for the work done.

- Commercial Invoice -It records sales details in an international trade and is required for customs clearance.

What are the uses of Invoices?

Sales and revenue tracking -Every time a sale happens, an invoice is made. Thus, it is the most reliable document to track revenue and sales numbers.Payment tracking -Along with details of products and services sold, an invoice also records the amount and payment due date. Hence, you can use it to track payments and initiate reminders.Document of legal protection -An invoice is recognized as proof of the exchange of goods in return for an agreed-upon price. Therefore, in case of a dispute, like a customer refusing to pay or claiming different prices, it can be used as evidence.Simplify tax filing process -Invoice helps businesses for accurate tax reporting. For the buyer, it is essential to get the tax benefits.Authenticity and brand image -Invoices help businesses look professional. It can make a good first impression on the customers who remember your brand and return later.What is a Bill?

A bill is a document that the seller gives to the buyer after the delivery of the purchased items. Generally, at the point of sale, the seller gives it to the buyer following the transaction.

What are the types of bills?

There are several types of bills you pay on a day-to-day basis:

Electricity Bill -A statement of your usage of electricity and total payable amount calculated by multiplying usage unit with price per unit.Water Bill -A statement of cost due to water usage.Gas Bill -A statement of cost due to gas usage.Credit Card Bill -A statement against payment made using a credit card during a month.Phone Bill - Usage-based cost of a postpaid network connection or landline.Medical Bill -Cost of purchase of medicines.Internet Bill -A quarterly or monthly statement of the cost of a broadband/internet connection.Grocery Bill -Statements of daily, weekly, or monthly spending on fruits, vegetables, cereals, pulses, and other grocery items.What are the uses of bills?

Purchase record -Bills help you track your purchase details so you can revisit and evaluate expenses and check for disputes and errors.Payment reminder -Bills are alarms that remind you to make payments. You would often get notifications and reminder messages from credit card issuers, electricity boards, telecom, and internet providers so you don’t miss out on paying bills before the due date.Bill payment -Paying bills requires an official statement so you know how much to pay and what the due date is.Verify expenditure -Bills add up to give you a clear picture of your total expenditure.Budgeting -Assessing bills helps identify areas where you can cut unnecessary costs and thus improve budgeting.Financial reporting (ITR filing) -Declaring some expenses when filing taxes and attaching bills helps save tax.Although invoices and bills include similar details, they vary in their purpose. They both have their value in a transaction. And, now that you are clear about the difference between the two, the next time you make or receive a payment, you will know what you are dealing with: an invoice or a bill.