An invoice might sound fancy, but we have seen, used and encountered it daily. Remember when you visit a grocery store to buy fresh veggies, proteinaceous eggs or your favourite yoghurt? Have you noticed what happens at the billing counter? The guy at the billing counter generates an invoice before printing the bill. Also, when you purchase an item on Amazon, Flipkart, IKEA, Nykaa, or any other eCommerce store you love, they send you an invoice via email, or you can download it by logging into your account on the app. Also, you get an invoice when you take a gym membership or visit a club, restaurant or medical store. In short, every transaction involves generating an invoice.

Another trend to note in the world of invoices is that when the world moves towards digitalization, businesses are streamlining their invoicing and billing systems by introducing e-invoicing or software-based billing.

So, what is meant by invoice?

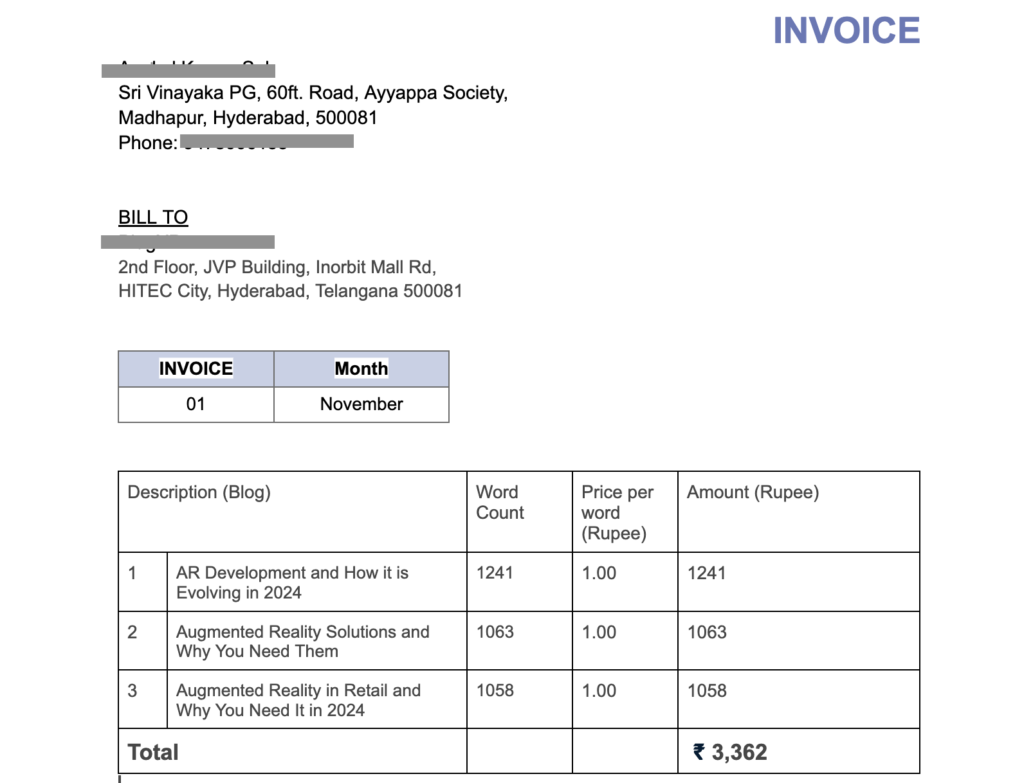

By invoice definition, it is the itemized legal document a seller gives the buyer, which the buyer must pay for. It records item details, quantity and the total amount due for the product or service sold. It may also contain taxes, discount details and payment due dates.

There are different types of invoices, and in common, they all include some or all of the following details:

- A mention that it is an #INVOICE

- An invoice number

- Seller name and address

- Buyer name and address (as BILLED TO)

- Date and time of product or service delivery

- Date and time when the invoice is generated

- Product or service quantity

- Cost per unit of the product or service

- Total cost of the items sold

- The final amount that a buyer must pay (on adding taxes and discounts, if any)

- Accepted payment options

- Payment terms

- Terms and conditions specifying return and replacement policy, late fee and other applicable charges outside the invoice, like platform fee

When does a seller issue an invoice?

A seller issues an invoice after they deliver the product or service or upon order confirmation. At businesses where there is a point-of-sale (POS), for instance, at a restaurant, the seller generates an invoice immediately after order confirmation or purchase. For recurring purchases like email platform subscriptions, marketing, and sales automation software subscriptions, or subscriptions to billing software, the seller sends an invoice at the end of a cycle, weekly, monthly, and yearly.

What does an invoice look like?

What purposes does an invoice serve?

An invoice is a crucial document that validates a purchase. Thus, it serves many purposes, which are:

Pricing & benchmark for negotiation

You often see vendors computing prices of items you pick using invoices, with prices they plan to charge against items you select. However, as a buyer, if you do not agree with the set price, you can negotiate the deal either item by item or on the overall cost. You could ask for a discount in percentage or an absolute discount on the lump sum invoice amount.

Payment terms

You can use an invoice to define the payment terms. Sometimes, you choose to make an immediate payment or choose a due date. It can also determine whether you pay through cash, UPI, card, or net banking. Thus, it defines payment terms, mode, duration and due date.

Dispute resolution

In case of a dispute related to a transaction and payment, you can refer to the information and agreed-upon terms of an invoice to confirm details. Sometimes, there can be a conflict or disagreement with the item quality, quantity, taxes, discounts or other aspects of your transaction. Things that a seller or a buyer might have agreed upon in person may not have come true. In such a case, invoice details are the first to look at before contacting the vendor.

So, what do we conclude?

The importance of invoices has grown with time. In the world of digital transformation, both sellers and buyers prefer clean transactions and clear record-keeping. People are more aware of the need to ask for an invoice and why it can be the best document to refer to in case of a dispute. However, we have moved beyond paper invoicing, and thus, it makes more sense today to switch to electronic invoicing, a convenient choice.

Leave a Reply